Cost Per Lead vs Cost Per Acquisition: When Each Metric Drives Sustainable Growth

Updated on

Published on

Few metrics create more confusion than CPL and CPA. One tells you what it costs to start a conversation. The other tells you what it costs to win a paying customer. If you optimise the wrong one at the wrong time, you can flood your pipeline with cheap leads that never convert or starve a proven funnel in the name of perfect efficiency. The fix is simple once you know where you are in the journey and how your lead-to-customer rate behaves.

At a glance

- CPL shows the cost to generate qualified interest; CPA shows the cost to acquire a customer.

- Use CPL when you are testing channels, messages, and audiences to find scalable demand.

- Use CPA when your sales conversion is predictable and you are tuning for unit economics and payback.

- Translate between CPL and CPA with one number: lead-to-customer rate.

- Bring offline closes back into ad platforms so CPA reflects real revenue impact.

Methodology

- Definitions and formulas reference primary documentation for cost per lead and cost per acquisition.

- Recommendations reflect how ad platforms actually bid and attribute conversions.

- Where helpful, we include recent benchmarks so your CPL and CPA targets are grounded in reality.

CPL vs CPA Explained

CPL, or cost per lead, is your spend divided by the number of leads you create in a period. It measures the efficiency of demand capture at the top or middle of your funnel. CPA, or cost per acquisition, is your spend divided by the number of acquisitions you care about, most often new customers. In platform terms, CPA can also mean cost per action, so always define whether your “A” is a lead, a sale, or another conversion. For formulas and platform context, see the cost per lead definition and Google’s Target CPA overview. (HubSpot Blog)

- CPL formula: marketing spend ÷ leads.

- CPA formula: marketing spend ÷ acquisitions or actions you defined.

- Align your teams on which event “counts” so reports never conflict.

When to focus on CPL

If you are still proving product–market fit, entering a new segment, or opening new channels, optimise for a low and stable cost per lead. At this stage, your goal is to learn fast, not to squeeze every cent of efficiency, so you want more qualified conversations to study messaging, creative, and audience fit. A healthy CPL tells you the top of your funnel is affordable, even if close rates are still in flux. Use form-quality checks and lead scoring so a low CPL does not hide junk.

- New markets, offers, or channels benefit from CPL targets while you learn.

- Pair CPL with quality indicators like qualification rate and meeting set rate.

- Pause creative that drops CPL but tanks down-funnel metrics.

.webp)

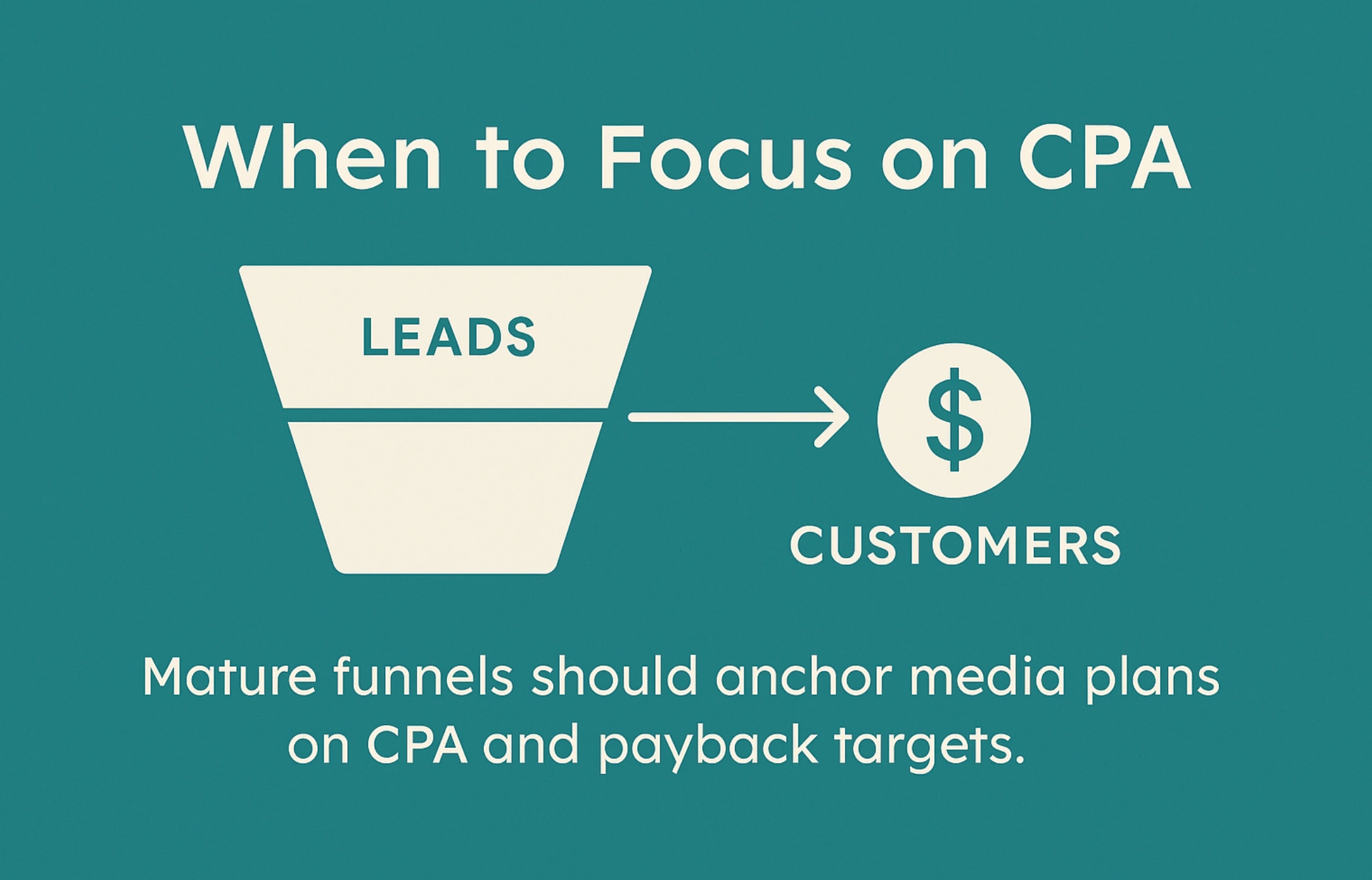

When to focus on CPA

Once your sales process is predictable and your lead-to-customer rate is known, optimise for cost per acquisition. CPA lines up with unit economics and payback math, which makes it the right yardstick for sustainable growth. It also fits how platforms bid. Google’s Target CPA, for example, aims bids at a cost per conversion that you set, so your budget naturally flows to ad groups and audiences that close customers at or under goal. (Google Help)

- Mature funnels should anchor media plans on CPA and payback targets.

- Use CPA at the offer level, not just the account level, so budgets follow winners.

- Revisit CPA goals when prices, close rates, or sales cycle length change.

Translate CPL to CPA with one conversion rate

You can convert between CPL and CPA with your lead-to-customer rate. The formula is simple: implied CPA = CPL ÷ lead-to-customer rate. If CPL is 20 dollars and 5 percent of leads become customers, implied CPA is 400 dollars. The reverse is just as useful: target CPL = target CPA × lead-to-customer rate. If your target CPA is 250 dollars and your lead-to-customer rate is 8 percent, your max CPL is 20 dollars. In many B2B funnels, lead-to-customer rates often sit in the low single digits, which is why a cheap cost per lead can still hide an expensive cost per acquisition. (Martal Group)

- Keep this math in your planning sheet so media and sales operate with the same constraints.

- Track the rate by channel and offer, not just overall, then set different CPL caps accordingly.

- Recalculate whenever qualification rules or sales coverage change.

-1.webp)

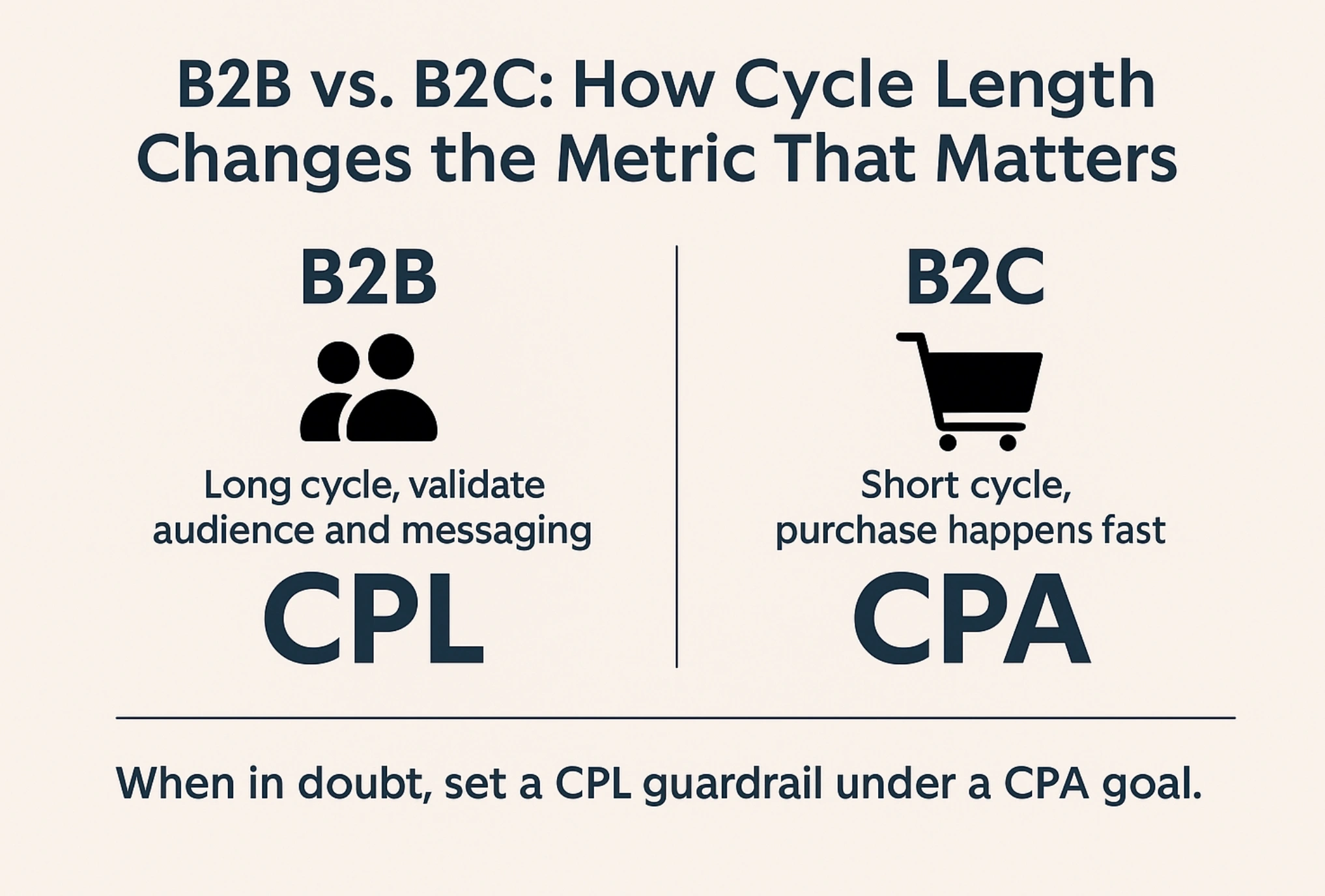

B2B vs B2C: how cycle length changes the metric that matters

B2B teams with long cycles and multi-touch journeys usually start with CPL while they validate audience and messaging, then graduate to CPA once pipeline and close rates stabilise. B2C teams with short cycles can jump to CPA sooner because purchase happens close to the click and the platform can learn faster. Either way, the moment your lead-to-customer rate is reliable, CPA becomes the cleaner goal because it directly reflects cost per acquisition and payback.

- Long cycles and offline steps delay reliable CPA signals, so weight CPL first.

- Short cycles and clear ecommerce events support CPA from day one.

- When in doubt, set a CPL guardrail under a CPA goal so both stay healthy.

Measurement that keeps CPL and CPA honest

If you close revenue offline, import those conversions so your CPA shows what really happened after the form. Google Ads supports offline conversion imports and Meta offers the Conversions API for server-side events, both designed to tie media to sales that happen in your CRM. This keeps platform bidding and your reporting aligned with actual cost per acquisition instead of proxy actions. (Google Help)

- Pass lead stage changes and closed-won events back to ad platforms.

- Use consistent primary keys so deduplication works across systems.

- Build a weekly review that compares platform CPA to finance numbers.

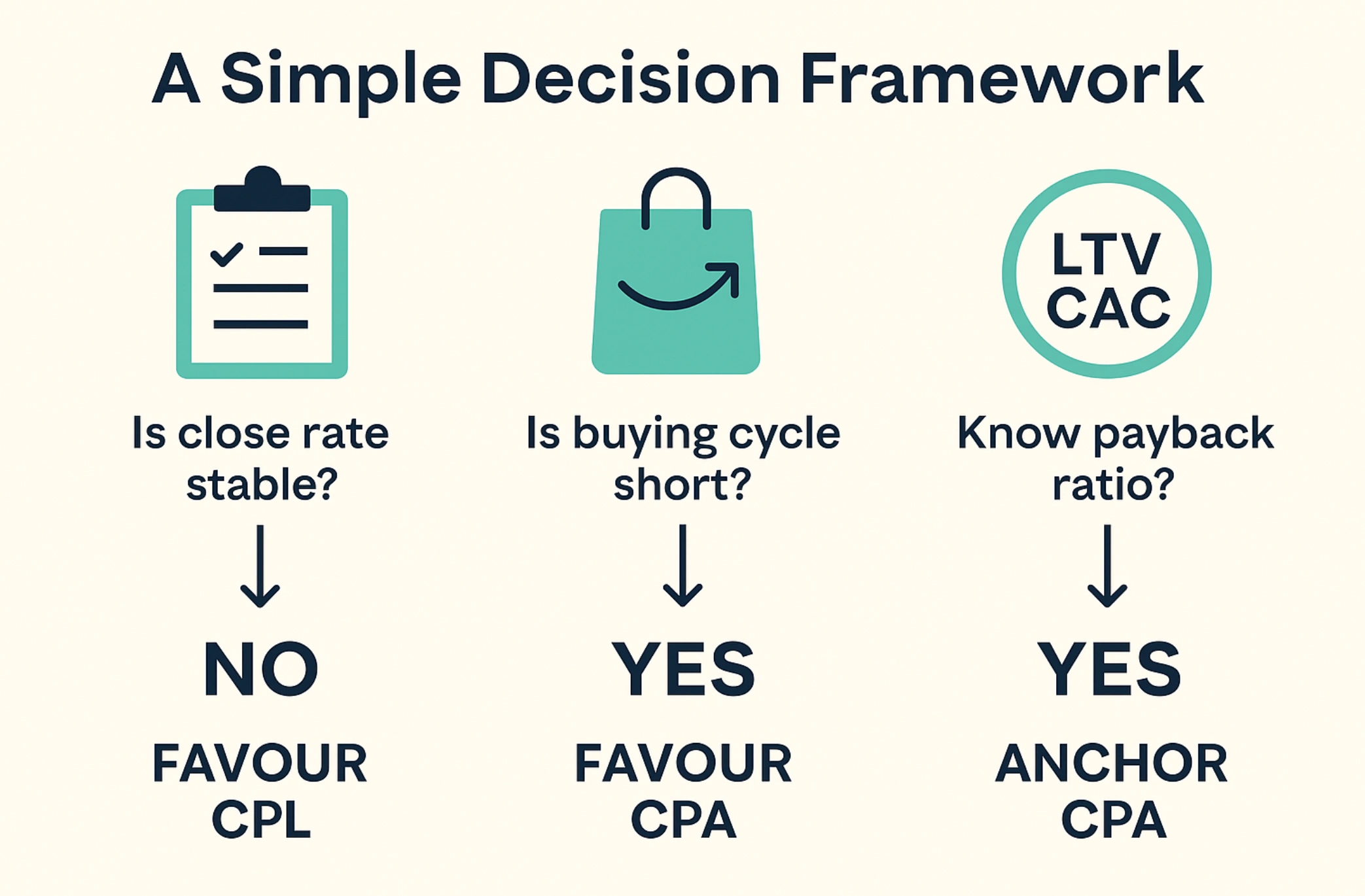

A simple decision framework

Pick the metric by answering three questions. Is your close rate stable? If no, favour CPL to learn faster. Is the buying cycle short and mostly online? If yes, favour CPA so bids optimise to customers. Do you know your target payback or LTV to CAC ratio. If yes, anchor CPA to that number and let CPL float inside guardrails. If any answer changes, switch the primary KPI accordingly.

- Early stage or new channel: CPL primary, CPA secondary.

- Proven funnel or ecommerce: CPA primary, CPL guardrail.

- Hybrid or offline heavy: CPL early, CPA after offline import is live.

Common mistakes to avoid

Three traps derail teams. First, celebrating a new “record low CPL” while qualification and meetings collapse. Second, letting platforms count a lead form as an acquisition, which understates true CPA. Third, setting a global CPA target that strangles promising but young campaigns that need learning budget. The cure is to define events precisely, set stage-appropriate goals, and translate between CPL and CPA with real conversion rates. For context on how platforms label CPA and “actions,” review the cost per action definition used in common ad tools. (WordStream)

- Write one line definitions for lead, MQL, SQL, opportunity, and customer.

- Map each platform event to those definitions to prevent double counting.

- Use separate targets for branded, non-branded, and retargeting.

FAQ

What is the difference between CPL and CPA?

CPL measures the cost to generate a lead and CPA measures the cost to acquire a customer or defined action; always specify which action counts in your CPA.

When should I optimise for CPL instead of CPA?

Use CPL when entering new markets or channels and you need more qualified volume to learn before your close rate is stable.

How do I convert a target CPA into a target CPL?

Multiply target CPA by your lead-to-customer rate; for example 250 dollars × 8 percent equals a max CPL of 20 dollars.

Why does platform CPA sometimes look better than finance CPA?

Platforms may count a form or add-to-cart as the action, so import offline conversions to align reports with real customer acquisition.

What is a good lead-to-customer rate to assume?

It varies by industry and motion; many B2B funnels sit in the low single digits, which is why cheap CPL can still hide an expensive CPA.

Pick the right yardstick

CPL and CPA are not rivals. They are complementary lenses that help you scale responsibly. Start with cost per lead when you need speed and learning. Graduate to cost per acquisition when your funnel is predictable and you are tuning for durable unit economics. Translate between them with your lead-to-customer rate, and you will know exactly when to chase volume and when to press for efficiency.

webp.webp)

webp.webp)